FAQ – New to Medicare & Medigap

After having group or individual insurance in the past, seniors aging into Medicare are often confused by the complexities of government-run Medicare. The amount of options available with Medicare can be overwhelming and difficult to discern. There are millions enrolled in Medicare, all with different needs, hence why so many options. We are always focused on helping you navigate the best plan that best fits your needs and perform a yearly complimentary analysis to monitor changes and ensure your plan still meets your needs. You don’t need to make changes every year, but it’s best to review your options.

When and how do I sign up for Medicare?

If you are currently receiving Social Security, you will be automatically enrolled into “original” Medicare (Part A and Part B). One day, about three months before your 65th birthday, your Red, White and Blue card will show up in the mail. At that time, if you choose, you can add a Medigap plan and Part D (prescription drug plan). Please speak with us about the Part D plan, as there can be a penalty accessed later on depending on your decision during this time. If you are not receiving Social Security yet, Medicare enrollment will require steps taken by you. You will still be automatically enrolled in Part A ONLY and receive your Red, White and Blue card around three months before your 65th birthday. You will need to enroll in Part B (medical coverage portion). To enroll in Medicare, go to www.medicare.gov or visiting a local Social Security office 2-3 months before the month that you turn 65.

I’m covered by my employer group plan, do I need Medicare?

If you are covered by an employer group plan, do not sign up for Medicare as it triggers your Initial Enrollment Period for Medigap and Part D. This could enact penalties in the future as well as loss of guaranteed issue ignoring pre-existing conditions and subjecting you to medical underwriting. This isn’t a difficult decision, but there are some variables. Call Adolph Benefits Consulting at 443-402-3170 and speak with a Licensed Health Insurance Agent. On this call, we can verify if your current coverage is deemed credible through Medicare and go over all of your options. In the end, you make the decisions, we are just here to educate and inform.

Does Medicare cover Dental, Vision and Hearing?

Medicare does not cover routine, preventative or really any costs associated with dental, vision or hearing. There are very affordable insurance plans you can purchase to go with your Medicare coverage that will cover dental, vision, hearing or any combination of the three. The plans range around $40/month and may have a waiting period before coverage can begin.

How much will Medicare cost?

Unfortunately, there is no clear-cut answer to this question. Beyond all of the variables, premiums change yearly, those in different income brackets pay different amounts. What we can tell you is Medicare Part A is premium-free for most people. If you worked in the United States and contributed to taxes for 10 years or 40 quarters, you’ve already paid in advance for your Part A and receive these benefits premium-free. If you aren’t entitled to premium-free Part A, your Premium can be up to $506/month. Medicare Part B has a monthly premium in 2024 of $174.80. If you elect a Medigap policy to “fill in the gaps” left by Medicare, these plans range on average nationally $120/month. What we feel is an important addition is the Part D, prescription drug plan, not covered by Medicare or Medigaps. Luckily, it’s priced economically at a $32.74/month national average (2023), but is income related. Please call one of our Licensed Health Insurance Agents at 443-402-3170 for a complimentary walk-through and in additional, we can check if you are eligible for any of the related subsidies or discounts that may be available.

All these letters seem like Alphabet soup, please provide some clarity…

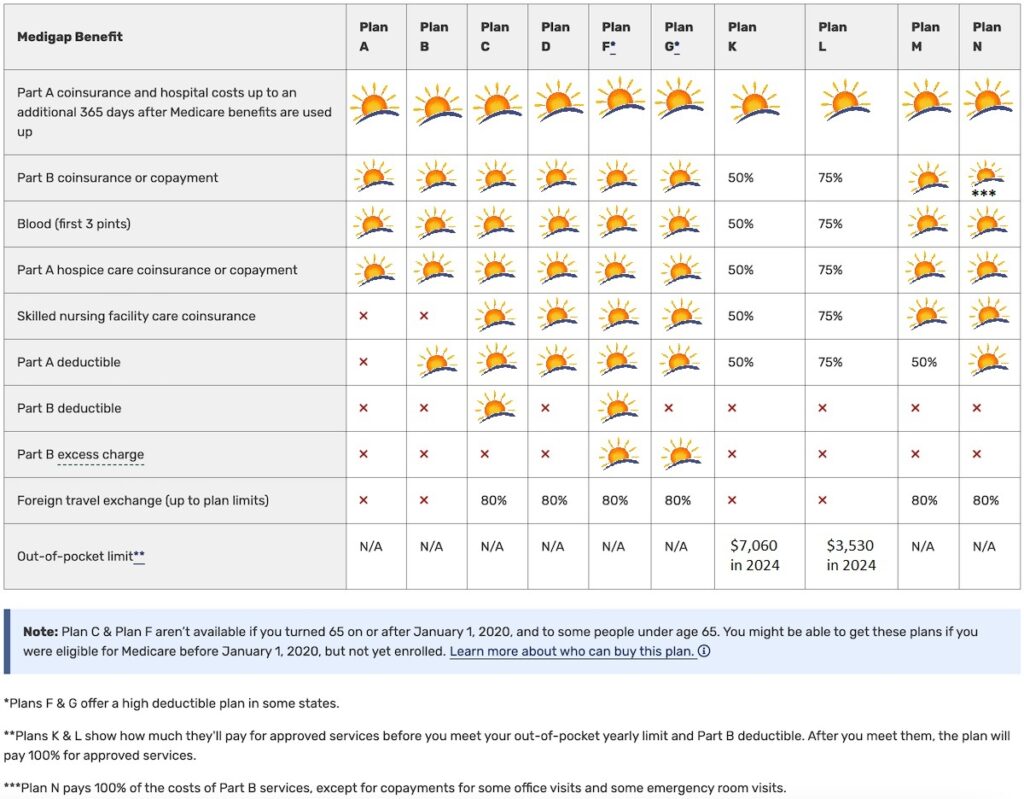

The chart below, from Medicare.gov shows basic information about the different benefits Medigap policies cover.

√ = the plan covers 100% of this benefit

X = the plan doesn’t cover this benefit

% = the plan covers that percentage of this benefit and you’re responsible for the rest

N/A = not applicable

The Medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the Medigap policy also covers your deductible).

What is the differences between Medicare Advantage (Plan C) and Medigap plans?

These two could not be more different in what they offer. Medicare Advantage plan replace your original Medicare, Medigap plans work with original Medicare to fill in the coverage gaps. Medicare Advantage plans have a network (mostly HMO’s or PPO’s like you’re accustomed to). Medigap plans have no networks – they can be used anywhere that accepts Medicare. Medigap plans usually have higher premiums, but offset by fewer out-of-pocket costs. These plans are also guaranteed renewable and you can never be cancelled unless you stop paying your premium.

Which is the best Medigap company?

All Medigap plans pay claims through the Medicare “crossover” system. This is Medicare’s system that ensures that companies pay claims in the same amount and on the same time schedule. The coverage of these plans are Federally standardized and have the exact same benefits from one company to the other. Choosing a higher rated company with the best rates are usually the most appealing.

When will my coverage begin?

Your coverage will begin on the 1st day of your birthday month, unless your birthday is on the 1st, then your coverage will begin the 1st day of the previous month.

How do I use my Medigap plan?

Any doctor that accepts Medicare is required to accept your Medigap plan. Present your Red, White and Blue Medicare card, along with your Medigap card. Coverage is coordinated through the Medicare “crossover” system with Medicare paying it’s portion, then coordinating payment from the supplemental Medigap company. Very easy to use!

When can I enroll in a Medigap plan?

Beyond your Initial Enrollment Period (IEP) with guaranteed coverage, you can change your Medigap plans at any time. However, if after your IEP you will likely have to answer medical questions to underwriting to be eligible to change companies and/or plans.

Can I compare Part D plans?

This part is essential so that we can determine that your plan will both cover your medications affordably and also work at your preferred pharmacy. We will run cost analysis to provide you with the lowest overall annual costs. Part D plans are plentiful and can vary tremendously in coverage.